Newly “Mynted”

The Internet has been around for years, but the lockdown forced everyone to depend on it in a lot more ways. Martha Sazon of GCash gives us front-row seats to the biggest shifts in consumer behavior: the surge of digital services, cashless transactions, and the wallet of the New World

Words by JOY ROJAS and AN MERCADO-ALCANTARA

No matter how long you’ve been working, there’s no getting past a case of new-job jitters.

Especially when it’s in the middle of a pandemic. And your job happens to be leading a company thrust into a critical role practically overnight. And you have to orchestrate all of that from home.

That was the challenge that Martha Sazon faced in her first week of work as president and CEO of Mynt (operator of GCash). Her appointment on June 1, 2020 came smack in the middle of a pandemic and ongoing quarantine measures against COVID-19.

Martha Sazon

Martha Sazon is a veteran. She had made her mark in a slew of industries like consumer goods, pharmaceuticals, and telecommunications. She spent 12 years with Globe, four of them as senior vice president of its broadband business. As she led the company’s teams—postpaid, mobile, small and medium businesses, broadband—Martha was already introducing innovations and learning how to localize them for the Filipino market. She was already in the frontlines of digital transformation.

However, nobody could have anticipated the seismic changes of consumer behavior during the pandemic. As consumers locked down, adoption of new digital services took off at breakneck speed. Malls and stores shut down, forcing people to shop online. Hyper local businesses blossomed in home kitchens and living rooms, requiring easy payment methods. People also feared that paper bills and coins could transmit the virus as it changed hands. Digital transactions were suddenly seen as the only safe and convenient way for people to spend, send and receive money.

Safe and convenient transactions. GCash helped customers avoid long lines at the malls and payment centers. And for those who could not leave the house, because they were high-risk or had no transportation, it was the only way to pay bills, send or receive money, or buy essential goods.

GCash was already well positioned to help consumers race into the world of contactless and cashless transactions, so Martha had to hit the ground sprinting. “I’ve been having an average of 11 meetings a day,” Martha says. “What’s good is the business is growing. The velocity of transactions in GCash is so much faster and the volume is much higher. It’s also a big challenge. I need to run with the business, while I am still learning.”

GCash: The currency of the New Normal

Operated by Mynt (Globe Fintech Innovations, Inc.), a partnership between Globe Telecom, the Ayala Corporation, and Ant Group, GCash was established as early as 2004. Growth was steady, but many still resisted the idea of not seeing actual cash exchanged.

“If we compare ourselves to India, e-wallets are used quite extensively by their population. That’s because for a time the government disenfranchised cash,” Martha explains. “So nobody had a choice but to use e-wallets. Our counterpart to that is COVID-19. In a way, cash was disenfranchised by the pandemic. It is now seen as dirty. Plus, physical exchanges are discouraged.”

All-in-one e-wallet. Customers could use Gcash to make payments, send money, buy load, and even donate to COVID-19 efforts. (Video source: GCash Youtube channel. “GCash Starter Guide” April 28, 2020)

So the lockdown triggered a mass conversion to GCash. Transactions surged by a mind-boggling 900% (compared to 2019). In the first seven days of June 2020, in fact, active users exceeded the number of users in all four weeks of April 2020. With twice as many registrations happening by the month, GCash became the top financial app in both Android and iOS, and ranked third among in-demand apps, following trending social media app TikTok and social conferencing app Zoom.

“GCash now has an average of two transactions per person per day,” Martha says. “That’s more than the number of times an average person goes to the bank in a week. It’s become as accessible as Messaging. Who would have thought that banking could be so simple!”

““GCash now has an average of two transactions per person per day. That’s more than the number of times an average person goes to the bank in a week.””

Cashless ecosytem

For all the simplicity that an e-wallet offers, though, it is easy to overlook the enormity of the pivot that is happening here. GCash is not just a digital purse but an entire ecosystem made up of customers,merchants, suppliers, apps, data service providers, and tech experts. The build up in GCash daily transfers and payments were bolstered by a robust network of funding and payment channels, a spike in digital lifestyle options, and a myriad of entry points for financial services.

Martha sees her role as a guardian of this ecosystem, closely watching how and why each element thrives. Her deep experience in both technology and marketing—drawing out consumer insights, trends, and behavior—give her vital perspective in understanding the new breed of digital consumers emerging from the pandemic.

Among the many things that intrigue her is the ability of the digital migrants to translate our physical world experiences into cyber space activities. “We Filipinos are very social by nature. We're able to cope because we stick together,” Martha observes. The isolation imposed by the lockdown became a catalyst for people to band together through virtual communities. “People are holding reunions and e-numan through Zoom. And businesses have found ways to come together through Viber communities, Facebook, and Instagram. What makes me happy is that GCash is there to enable these communities.”

Cash and bonds. Through GCash, people could still find a way to connect to other people—sending money to family back home, and even treating friends to a meal or a birthday gift. (Source: GCash Facebook)

In the early part of the year, GCash had 75,000 accredited merchants built up over a decade. In the first four months of the lockdown, over 10,000 merchants joined.On top of that,” Martha says, “there’s an unquantifiable number of send and receive money transactions between small buyers and sellers.”

What surprises her most about the new GCash generation is their growing financial literacy. Perhaps because of their anxiety over the economy and because GCash has financial instruments with low barriers to entry, younger people are exploring how they can save and invest. “I used to think that interest in financial services was more for the seasoned, senior people who have become wealthy through the years,” Martha shares. “But now it’s young people, the millennials or the yuppies, who are more concerned about it. They search for investment options to compare costs and product features. We can see this generation taking a more active role in their personal finances.”

The beauty of the app is its limitless potential to anticipate and serve new consumer behavior. Technology allows for growth in leaps and bounds, but one must also be passionately customer-focused. “Follow where they are going. At the same time have foresight,” Martha explains. “You need to know what the frictions are for the consumers, what their evolving needs are, how they are handling these, and what are in the experience that gives them a hard time. Then we match those insights with a technology-based solution.”

“ “You need to know what the frictions are for the consumers, what their evolving needs are... Then we match those insights with a technology-based solution.””

Immense Platform

Even as Martha was transitioning to her new post at the same time as thousands of consumers and merchants were migrating to the cashless ecosystem, there was a third transition happening at Mynt. GCash itself was migrating to a new technology platform. Think of it as not only changing tires while driving at high-speed, but also while the racetrack itself is being reconfigured.

Planned way before there was any hint of an oncoming pandemic, the move to theA+ platform was a directive from their joint venture partner Ant Group (an affiliate company of the Alibaba Group). With over a billion users, the platform would allow GCash to be part of the biggest mobile payment system in the world. “Kudos to our technology team,” Martha says proudly about the team heading the transition. “They declared no pandemic could stop us.”

Incredibly, the technology team successfully migrated over 20 million subscribers as planned, all while working from home. For the GCash teams who were handling the influx of transactions during the quarantine period, the move meant carefully coordinating down times so that service would not be interrupted when people needed their e-wallets the most. One of those coordinating very closely was Mynt Cluster Head Racquel Holazo, who was overseeing Makati City’s distribution of financial aid to 500,000 citizens through GCash. “We were worried at first that our disbursements might be affected by the system down time,” she recalls. Working methodically and through close coordination, the transfer was done and the social aid was distributed without a hitch.

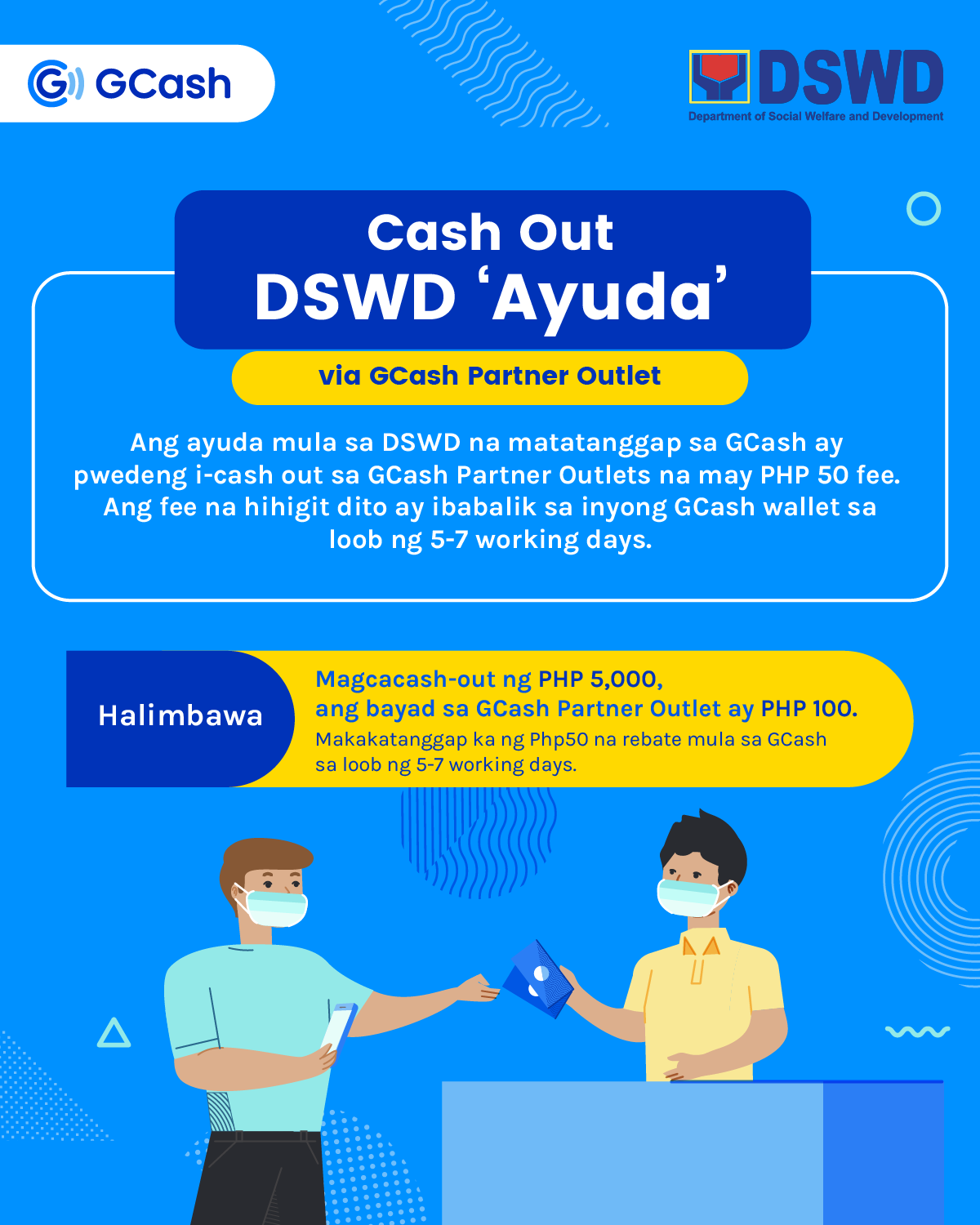

Financial lifeline. Makati City was the first to use GCash to distribute aid to 500,000 cities. Since then, several cities have followed suit, and DSWD also plans to use it to distribute the second tranche of aid—approximately billion pesos—to 2 million beneficiaries in 17 cities. (Photo Sources: GCash, DSWD and Mayor Joy Belmonte Facebook pages)

Now firmly on the new platform, GCash can take millions of new users with ease. And if the ripple effect of the Makati distribution is any indication, the expansion came just in time. Following Makati, Pasig City and Quezon City also distributed social aid through GCash. More significantly, the Department of Social Welfare and Development (DSWD) inked a deal with GCash for the second tranche of SAP; sharing a list of 2 million beneficiaries with a value close to 16 billion pesos. As Martha puts it, the immense new capacity of the platform makes GCash “future proof.”

What the people at Mynt see in the future is a predominantly cashless country where financial solutions are available to all. Even Governor Benjamin Diokno of the Bangko Sentral ng Pilipinas (BSP) told Martha he is looking forward to the time when they will not need to print money or mint new coins. There’s still a lot more that needs to be done, of course, to get the majority of the population on a firm digital footing. But Martha says, “When that time comes, we will be ready.”

Points for change. GCash also “mobile-lized” subscribers to participate in a good cause. Through GCash Forest—a 2019 project in partnership with the Department of Environment and Natural Resources (DENR), World Wildlife Fund (WWF) and The Biodiversity Finance Initiative (BIOFIN)—users could collect “green energy" whenever they used their app to adopt a tree in the Ipo watershed. (Video source: GCash Youtube. “What is the GCash Forest?” July 1, 2019)

Purpose-Driven

This audacious vision to make finance available for all is what gets Martha up in the morning. It is a mindset that was ingrained in her through the many years she spent at Globe, which puts great emphasis on service to others as intrinsic to doing business. “When you are clear about your long-term goal and your commitment to others, it makes you resilient and able to survive everyday difficulties,” Martha reveals.

The same resolve is also what drives the teams at Mynt. Martha is quick to say she cannot take credit for any of the success GCash is now enjoying. Instead, she credits her young team mates (the average age at Mynt is 29) for all they have done. “They’re switched on, they have this energy, and they’re driven by purpose too,” she says. “They know the purpose—finance for all—and most, if not all, of them are here because of that.”

Emergency cash. When offices and establishments closed during the lockdown, many people temporarily lost their only source of income. GCredit helped them stretch their finances until their next paycheck. Their credit limit was based on GScore, the first trust score in the Philippines. (Video source: GCash Youtube. “GCredit: Your Instant Pantawid Fund” September 3, 2020.)

Martha elaborates: “What I like about our goal of providing finance for all is that it democratizes financial services. We are creating products not just for the rich. It’s for everyone. When I came into GCash and saw the stats and insights, I got more inspired by the vision because I know that we are on our way there. ”

Her enthusiasm for her new purpose brims over at home, where her sons, 12 and 10, have had a front row view of the race she has taken on. “Sometimes my kids eavesdrop on my meetings or they just want to be with me,” says Martha. “Sometimes they quote me in my meetings and say, ‘Why did you talk about this, Mama?’ or ‘Mama, I’m going to pitch an idea to you about GCash.’ Parang talk show ata ako, eh. They get amazed by the job and understand my work. Work-life integration has never been more true.” The same might be said of the GCash journey. #

PUBLISHED SEPTEMBER 11, 2020